Give yourself a money makeover: the beauty of budgeting for women

Let’s dive into the wonderful world of budgeting, while the "B" word might sound daunting it's a journey worth embarking on. Budgeting is not all about clipping coupons or feeling restricted. It's about empowering ourselves, taking charge of our financial destinies, and living life to the fullest - without breaking the bank.

Budgeting or knowing where your money is going will help give you clarity and ultimately freedom. It gives you a clear roadmap to follow, helping you prioritise what truly matters.

By keeping track of your spending, you can avoid pesky "where did all my money go?" moments and retain control over your financial future.

How can a budget help me?

Picture this: you're planning a fabulous holiday, searching for your first home, or envisioning the retirement of your dreams.

How can you make these come true - without dipping into your emergency fund or maxing out your credit cards?

Here’s some great benefits of creating a budget:

- Guiding you in managing your money and maintaining control over your finances - here’s to being independent and having security.

- Outlining your income and how you plan to spend and save it - being mindful about your money and planning for the future is priceless.

- Enabling you to direct your money toward your goals - whether it’s that vacay, house or retirement by the beach.

- Serving as one of the most effective tools for maximising your financial resources and making financial progress - let’s get those gains!

In essence: What kind of budget should I have?

There are many ways to build a budget - so there’s something for every personality type. If you’re a whiz with Excel, why not draw up your own template? But if you need a bit more guidance, check out the Budgeting Tool on Sorted or browse through the many budgeting apps available in the App Store or Google Play.

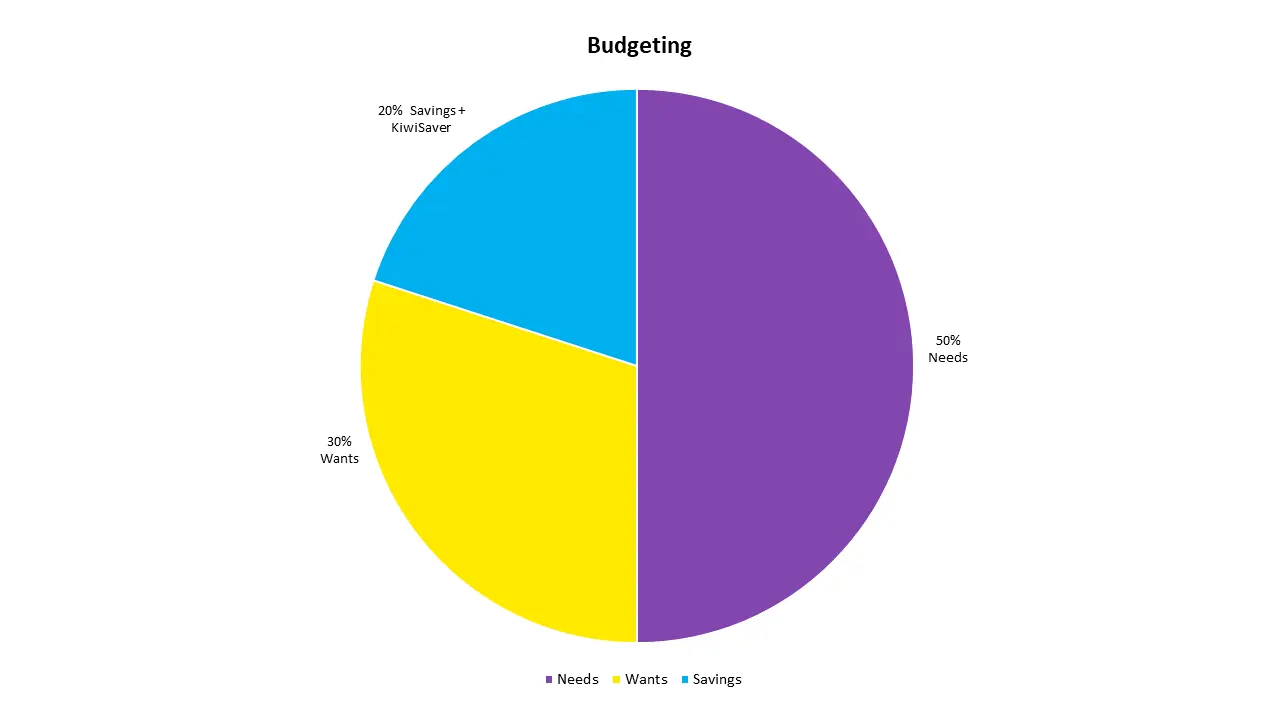

One popular budget model is the 50/30/20 rule. Following this model, you allocate 50% of your income on ‘’needs’’ - essential expenses like rent or a mortgage, groceries, utility bills, debt repayments, insurance and transport.

Then the next 30% of your income goes towards ‘’wants’’. These might include things like your Netflix subscription, dinners out, shopping or holidays.

Finally, the remaining 20% is put into savings. That can include a standard savings account, an emergency fund, and of course, a KiwiSaver account that can help you plan for a thriving retirement. You can contact a Mercer financial adviser here to talk all things KiwiSaver. We also recommend you speak to one of the team before or straight after you switch your KiwiSaver investment to Mercer.

Check out the graph below to see how the 50/30/20 budgeting model works.

Crunch the numbers and make the leap

-

First things first, to build your budget, gather all your financial information - payslips, bills, invoices and expenses, and record them in your budget document, template or app.

It’s amazing how seeing the numbers on paper brings them to life. It can be confronting to see how much you’re spending on UberEats - but also motivating to see all the information in one place. From this moment, you can choose how to move forward - and that’s pretty empowering.

Keep in mind that budgeting is not all about missing out - it’s about finding ways to treat yourself while ensuring your financial future is secure.

-

Track your income and outgoings, think about your ultimate goals. Whether it’s buying that apartment or retiring in a cosy cottage, keeping the end game in mind can really focus your budget. Having a purpose makes it that much easier to stick to.

-

Once you’re in the swing of using your budget, be sure to make time for regular check-ins. Are you consistently going over or under budget? Are you right on target?It’s normal to see some variance depending on what’s happening in life - so don’t beat yourself up if you don’t nail it right away. Give yourself the grace of flexibility as you begin. The fact that you’re already thinking about your spending is already a huge step.

And when you do reach a goal or milestone - be sure to celebrate your success!

Remember, budgeting is not just about the dollars and cents. It’s about embracing financial freedom and the way this can empower us as women. You deserve to give yourself a money makeover and reap the beautiful benefits of a budget - so why not get started today?

The above article is general information and does not purport to give financial advice. The Mercer KiwiSaver scheme and Mercer FlexiSaver are issued by Mercer (N.Z.) Limited. Product Disclosure Statements are available free of charge at seatatthetable.co.nz.